The stock market is one of the most important ways for companies to raise money, along with debt markets which are generally more imposing but do not trade publicly. This allows businesses to be publicly traded, and raise additional financial capital for expansion by selling shares of ownership of the company in a public market. The liquidity that an exchange affords the investors enables their holders to quickly and easily sell securities. This is an attractive feature of investing in stocks, compared to other less liquid investments such as property and other immoveable assets.

Investment in the stock market is most often done via stockbrokerages and electronic trading platforms. The overall market is made up of millions of investors and traders, who may have differing ideas about the value of a specific stock and thus the price at which they are willing to buy or sell it. The thousands of transactions that occur as these investors and traders convert their intentions to actions by buying and/or selling a stock cause minute-by-minute gyrations in it over the course of a trading day. A stock exchange provides a platform where such trading can be easily conducted by matching buyers and sellers of stocks.

For the average person to get access to these exchanges, they would need a stockbroker. This stockbroker acts as the middleman between the buyer and the seller. Getting a stockbroker is most commonly accomplished by creating an account with a well established retail broker. To facilitate this process, a company needs a marketplace where these shares can be sold. If everything goes as per the plans, the company will successfully sell the 5 million shares at a price of $10 per share and collect $50 million worth of funds.

Investors will get the company shares which they can expect to hold for their preferred duration, in anticipation of rising in share price and any potential income in the form of dividend payments. The stock exchange acts as a facilitator for this capital raising process and receives a fee for its services from the company and its financial partners. A stock market crash is often defined as a sharp dip in share prices of stocks listed on the stock exchanges.

In parallel with various economic factors, a reason for stock market crashes is also due to panic and investing public's loss of confidence. The secondary purpose the stock market serves is to give investors – those who purchase stocks – the opportunity to share in the profits of publicly-traded companies. The other way investors can profit from buying stocks is by selling their stock for a profit if the stock price increases from their purchase price. For example, if an investor buys shares of a company's stock at $10 a share and the price of the stock subsequently rises to $15 a share, the investor can then realize a 50% profit on their investment by selling their shares.

The exchange may offer privileged services like high-frequency trading to larger clients like mutual funds and asset management companies , and earn money accordingly. There are provisions for regulatory fee and registration fee for different profiles of market participants, like the market maker and broker, which form other sources of income for the stock exchanges. The stock exchange shoulders the responsibility of ensuring price transparency, liquidity, price discovery and fair dealings in such trading activities. As almost all major stock markets across the globe now operate electronically, the exchange maintains trading systems that efficiently manage the buy and sell orders from various market participants.

They perform the price matching function to facilitate trade execution at a price fair to both buyers and sellers. Price-Earnings ratios as a predictor of twenty-year returns based upon the plot by Robert Shiller (Figure 10.1). The horizontal axis shows the real price-earnings ratio of the S&P Composite Stock Price Index as computed in Irrational Exuberance (inflation adjusted price divided by the prior ten-year mean of inflation-adjusted earnings). The vertical axis shows the geometric average real annual return on investing in the S&P Composite Stock Price Index, reinvesting dividends, and selling twenty years later. Data from different twenty-year periods is color-coded as shown in the key. A stock exchange is an exchange where stockbrokers and traders can buy and sell shares , bonds, and other securities.

This makes the stock more liquid and thus more attractive to many investors. These and other stocks may also be traded "over the counter" , that is, through a dealer. Some large companies will have their stock listed on more than one exchange in different countries, so as to attract international investors. Indices can be broad such as the Dow Jones or S&P 500, or they can be specific to a certain industry or market sector. Investors can trade indices indirectly via futures markets, or via exchange traded funds , which trade like stocks on stock exchanges.

Some stock markets rely on professional traders to maintain continuous bids and offers since a motivated buyer or seller may not find each other at any given moment. A two-sided market consists of the bid and the offer, and the spread is the difference in price between the bid and the offer. The more narrow the price spread and the larger size of the bids and offers , the greater the liquidity of the stock.

Moreover, if there are many buyers and sellers at sequentially higher and lower prices, the market is said to have good depth. Stock markets of high quality generally tend to have small bid-ask spreads, high liquidity, and good depth. Likewise, individual stocks of high quality, large companies tend to have the same characteristics.

Once the company's shares are listed on a stock exchange and trading in it commences, the price of these shares will fluctuate as investors and traders assess and reassess their intrinsic value. There are many different ratios and metrics that can be used to value stocks, of which the single-most popular measure is probably the Price/Earnings ratio. The stock analysis also tends to fall into one of two camps—fundamental analysis, or technical analysis. A stock market is a similar designated market for trading various kinds of securities in a controlled, secure and managed environment. Since the stock market brings together hundreds of thousands of market participants who wish to buy and sell shares, it ensures fair pricing practices and transparency in transactions. While earlier stock markets used to issue and deal in paper-based physical share certificates, the modern day computer-aided stock markets operate electronically.

The stock market refers to the collection of markets and exchanges where regular activities of buying, selling, and issuance of shares of publicly-held companies take place. Such financial activities are conducted through institutionalized formal exchanges or over-the-counter marketplaces which operate under a defined set of regulations. There can be multiple stock trading venues in a country or a region which allow transactions in stocks and other forms of securities. The stock market or stock exchange is a marketplace where individuals and institutions can buy and sell stocks/securities of listed companies.

'Securities' or 'Stock' refers to equity shares that offer ownership in a company. There are over 1,4 million securities tradeable such as stocks, bonds, ETFs, ETCs, ETNs, funds, warrants and certificates. On the stock exchange supply and demand of securities are brought together and offset by price determination and executed at these prices, mediated by specialists in floor trading . Targets of exchange trading are enhanced market transparency, greater liquidity, reducing of transaction costs and security against manipulation. Two of the basic concepts of stock market trading are "bull" and "bear" markets. The term bull market is used to refer to a stock market in which the price of stocks is generally rising.

This is the type of market most investors prosper in, as the majority of stock investors are buyers, rather than short-sellers, of stocks. A bear market exists when stock prices are overall declining in price. Financial innovation has brought many new financial instruments whose pay-offs or values depend on the prices of stocks. Some examples are exchange-traded funds , stock index and stock options, equity swaps, single-stock futures, and stock index futures. These last two may be traded on futures exchanges (which are distinct from stock exchanges—their history traces back to commodity futures exchanges), or traded over-the-counter.

As all of these products are only derived from stocks, they are sometimes considered to be traded in a derivatives market, rather than the stock market. We offer access to free stock quotes, stock charts, breaking stock news, top market stories, free stock analyst ratings, SEC filings, stock price history, corporate events, public company financials and so much more. Stock Market (StockMarket.com) is a true disrupter, vastly improving the way people consume financial market data. Numerous studies have shown that, over long periods of time, stocks generate investment returns that are superior to those from every other asset class.

A capital gain occurs when you sell a stock at a higher price than the price at which you purchased it. A dividend is the share of profit that a company distributes to its shareholders. Dividends are an important component of stock returns—since 1956, dividends have contributed nearly one-third of total equity return, while capital gains have contributed two-thirds. Today, there are many stock exchanges in the U.S. and throughout the world, many of which are linked together electronically. It allows companies to raise money by offering stock shares and corporate bonds.

It lets common investors participate in the financial achievements of the companies, make profits through capital gains, and earn money through dividends, although losses are also possible. Stockbrokers, also known as registered representatives in the U.S., are the licensed professionals who buy and sell securities on behalf of investors. The brokers act as intermediaries between the stock exchanges and the investors by buying and selling stocks on the investors' behalf.

An account with a retail broker is needed to gain access to the markets. Say, a U.S.-based software company is trading at a price of $100 and has a market capitalization of $5 billion. A news item comes in that the EU regulator has imposed a fine of $2 billion on the company which essentially means that 40 percent of the company's value may be wiped out. Following the first-time share issuance IPO exercise called the listing process, the stock exchange also serves as the trading platform that facilitates regular buying and selling of the listed shares. The stock exchange earns a fee for every trade that occurs on its platform during the secondary market activity.

As a primary market, the stock market allows companies to issue and sell their shares to the common public for the first time through the process of initial public offerings . This activity helps companies raise necessary capital from investors. It essentially means that a company divides itself into a number of shares and sells a part of those shares to common public at a price (say, $10 per share).

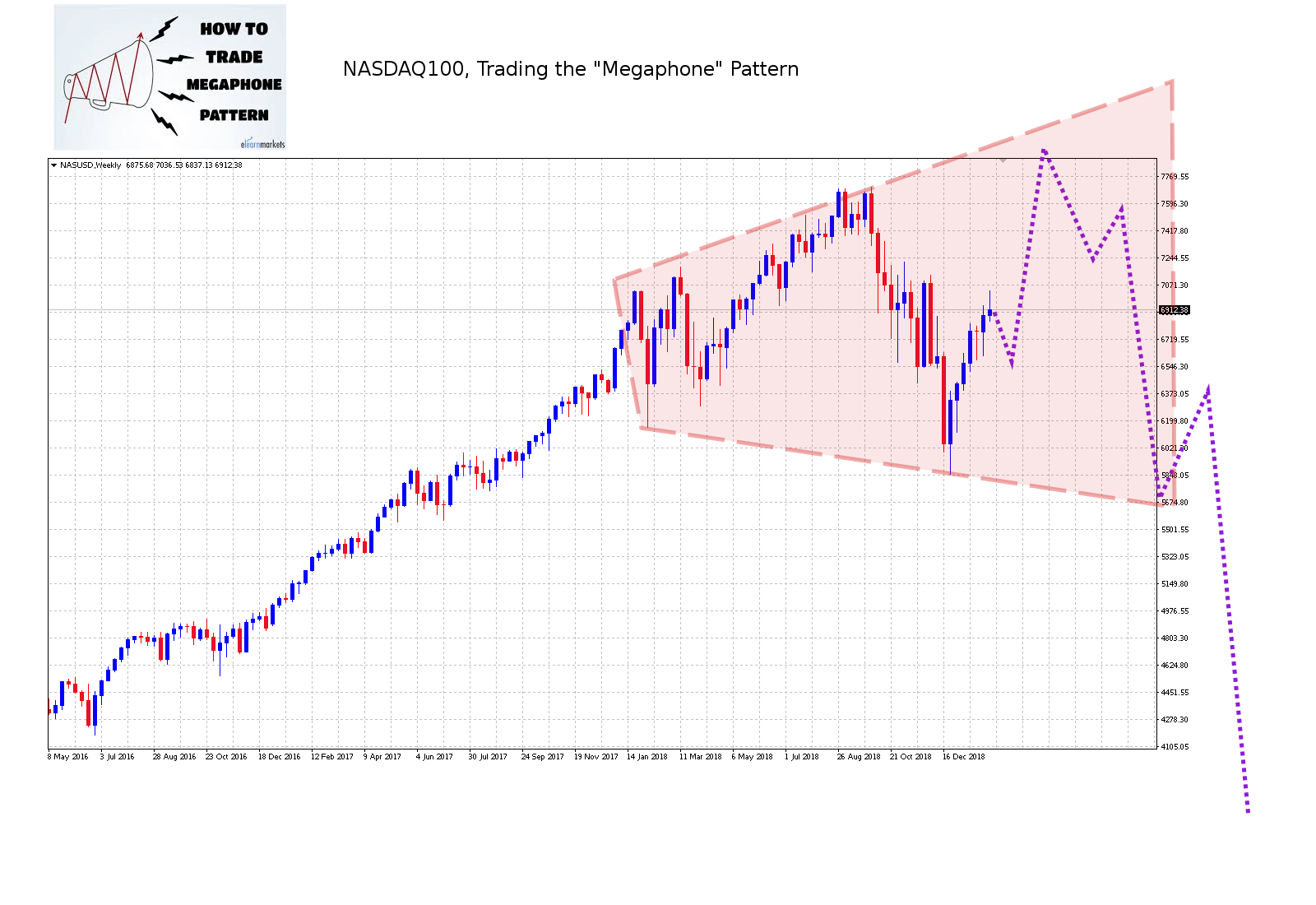

Many strategies can be classified as either fundamental analysis or technical analysis. Fundamental analysis refers to analyzing companies by their financial statements found in SEC filings, business trends, and general economic conditions. Technical analysis studies price actions in markets through the use of charts and quantitative techniques to attempt to forecast price trends based on historical performance, regardless of the company's financial prospects. One example of a technical strategy is the Trend following method, used by John W. Henry and Ed Seykota, which uses price patterns and is also rooted in risk management and diversification. The movements of the prices in global, regional or local markets are captured in price indices called stock market indices, of which there are many, e.g. the S&P, the FTSE and the Euronext indices. Such indices are usually market capitalization weighted, with the weights reflecting the contribution of the stock to the index.

The constituents of the index are reviewed frequently to include/exclude stocks in order to reflect the changing business environment. The crash in 1987 raised some puzzles – main news and events did not predict the catastrophe and visible reasons for the collapse were not identified. This event raised questions about many important assumptions of modern economics, namely, the theory of rational human conduct, the theory of market equilibrium and the efficient-market hypothesis. For some time after the crash, trading in stock exchanges worldwide was halted, since the exchange computers did not perform well owing to enormous quantity of trades being received at one time. This halt in trading allowed the Federal Reserve System and central banks of other countries to take measures to control the spreading of worldwide financial crisis. In the United States the SEC introduced several new measures of control into the stock market in an attempt to prevent a re-occurrence of the events of Black Monday.

Participants in the stock market range from small individual stock investors to larger investors, who can be based anywhere in the world, and may include banks, insurance companies, pension funds and hedge funds. Their buy or sell orders may be executed on their behalf by a stock exchange trader. The prices of shares on a stock market can be set in a number of ways, but most the most common way is through an auction process where buyers and sellers place bids and offers to buy or sell. A bid is the price at which somebody wishes to buy, and an offer is the price at which somebody wishes to sell. When you invest in the stock of a company it means you own a share in the company that issued the stock. Stocks investment is a way to invest in some of the most successful companies.

Companies use stocks as a way to raise money to fund growth, new products, and other important initiatives. OTC stocks are not subject to the same public reporting regulations as stocks listed on exchanges, so it is not as easy for investors to obtain reliable information on the companies issuing such stocks. Stocks in the OTC market are typically much more thinly traded than exchange-traded stocks, which means that investors often must deal with large spreads between bid and ask prices for an OTC stock.

In contrast, exchange-traded stocks are much more liquid, with relatively small bid-ask spreads. Domestically, the NYSE saw meager competition for more than two centuries, and its growth was primarily fueled by an ever-growing American economy. The LSE continued to dominate the European market for stock trading, but the NYSE became home to a continually expanding number of large companies. Other major countries, such as France and Germany, eventually developed their own stock exchanges, though these were often viewed primarily as stepping stones for companies on their way to listing with the LSE or NYSE. The concept of the bourse was 'invented' in the medieval Low Countries (most notably in predominantly Dutch-speaking cities like Bruges and Antwerp) before the birth of formal stock exchanges in the 17th century.

Until the early 1600s, a bourse was not exactly a stock exchange in its modern sense. In short selling, the trader borrows stock then sells it on the market, betting that the price will fall. The trader eventually buys back the stock, making money if the price fell in the meantime and losing money if it rose. Exiting a short position by buying back the stock is called "covering". This strategy may also be used by unscrupulous traders in illiquid or thinly traded markets to artificially lower the price of a stock.

Hence most markets either prevent short selling or place restrictions on when and how a short sale can occur. ], many studies have shown a marked tendency for the stock market to trend over time periods of weeks or longer. Various explanations for such large and apparently non-random price movements have been promulgated. For instance, some research has shown that changes in estimated risk, and the use of certain strategies, such as stop-loss limits and value at risk limits, theoretically could cause financial markets to overreact.

But the best explanation seems to be that the distribution of stock market prices is non-Gaussian . The Amsterdam Stock Exchange is said to have been the first stock exchange to introduce continuous trade in the early 17th century. The process of buying and selling the VOC's shares, on the Amsterdam Stock Exchange, became the basis of the world's first official stock market. The purpose of a stock exchange is to facilitate the exchange of securities between buyers and sellers, thus providing a marketplace.

The exchanges provide real-time trading information on the listed securities, facilitating price discovery. Some exchanges are physical locations where transactions are carried out on a trading floor, by a method known as open outcry. This method is used in some stock exchanges and commodities exchanges, and involves traders shouting bid and offer prices. The other type of stock exchange has a network of computers where trades are made electronically. Stocks can be categorized by the country where the company is domiciled. The NYSE and Nasdaq are the two largest exchanges in the world, based on the total market capitalization of all the companies listed on the exchange.

The number of U.S. stock exchanges registered with the Securities and Exchange Commission has reached nearly two dozen, though most of these are owned by either CBOE, Nasdaq or NYSE. The stock market also offers a fascinating example of thelaws of supply and demand at work in real time. Because of the immutable laws of supply and demand, if there are more buyers for a specific stock than there are sellers of it, the stock price will trend up.

Conversely, if there are more sellers of the stock than buyers, the price will trend down. When a company establishes itself, it may need access to much larger amounts of capital than it can get from ongoing operations or a traditional bank loan. It can do so by selling shares to the public through an initial public offering. This changes the status of the company from a private firm whose shares are held by a few shareholders to a publicly traded company whose shares will be held by numerous members of the general public.